Decentralized finance (DeFi) is booming amid a wave of U.S. deregulation. A new report by analytics firm Artemis (with DeFi yield platform Vaults.fyi) shows crypto asset managers have quadrupled their on-chain holdings since January – from about $1 billion to over $4 billion as of mid-2025.

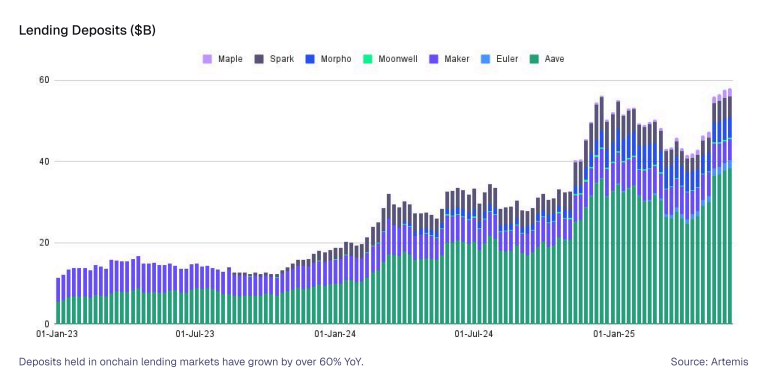

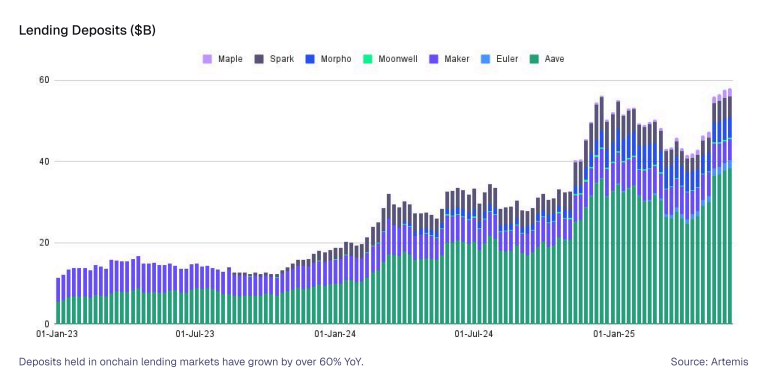

At the same time total value locked in top DeFi lending protocols (Aave, Morpho, Spark, etc.) has climbed past $50 billion (approaching $60 billion), a 60% gain year-on-year.

Industry observers credit President Donald Trump’s deregulatory agenda with bolstering institutional confidence in crypto. Trump has pushed new laws and bills aimed at easing crypto rules, helping to open DeFi’s floodgates.

Regulatory Tailwinds for Crypto

In Washington, Congress and the White House have moved to roll back key crypto regulations. On April 10, 2025 President Trump signed a bipartisan bill repealing IRS reporting requirements for DeFi brokers.

The move nullified rules from the 2021 infrastructure law that many feared would stifle DeFi innovation. Meanwhile, Trump has vocally backed the GENIUS Act (a stablecoin regulation bill).

The Senate passed the bill on June 17 by a 68–30 vote, and on June 19 Trump urged the House to pass it “lightning fast.”

He called the legislation “incredible” and said it will make “America the UNDISPUTED Leader in Digital Assets,” demanding that it reach his desk “ASAP — NO DELAYS, NO ADD ONS.”

These policy shifts have coincided with changing sentiment among institutional users. As DeFi infrastructure matures, Artemis and Vaults report that “institutional sentiment is moving towards seeing DeFi as a complementary, configurable financial layer” rather than a risky fringe.

In practice, many fintech firms, wallets and exchanges are quietly embedding DeFi in their products. In effect, they use decentralized protocols as a “back-end” to offer yield and loans to their customers.

DeFi Lending and Yield Markets Surge

Data from Artemis shows this trend in action. The combined TVL on major DeFi lending platforms has jumped by roughly 60% in a year, reaching about $50–60 billion by mid-June 2025.

According to the report, the Pendle protocol – which lets users tokenize and trade yield-bearing positions – now holds over $4 billion in TVL, most of it in stablecoin-based yield tokens.

Ethena’s “sUSDe” token, another popular yield-bearing USD stablecoin, has delivered returns above 8% through strategies like cash-and-carry trades.

User-facing products are offering yield without exposing users directly to DeFi. Coinbase, for instance, now pays interest on USDC deposits, and PayPal pays interest around 3.7% on its PYUSD stablecoin.

Crypto wallets are doing similar things: Bitget Wallet’s integration with Aave offers 5% APY on USDC/USDT without leaving the app.

And Coinbase’s crypto-backed loan service (via Morpho Protocol) has already originated over $300 million in loans this month, again hidden under a familiar interface. The report calls this fintech-front, DeFi-back hybrid the “DeFi mullet.”

These on-chain yield products are drawing fresh capital. Artemis notes that “stablecoin yield, crypto yield and crypto borrowing” are the three main ways institutions are using DeFi today.

Per the report, nearly $2 billion of the newly deployed capital is locked into just one DeFi lending platform (Morpho Protocol). Overall, decentralized stablecoin and yield markets now form the foundation of a multi-billion-dollar industry.

Crypto-Native Asset Managers Rise

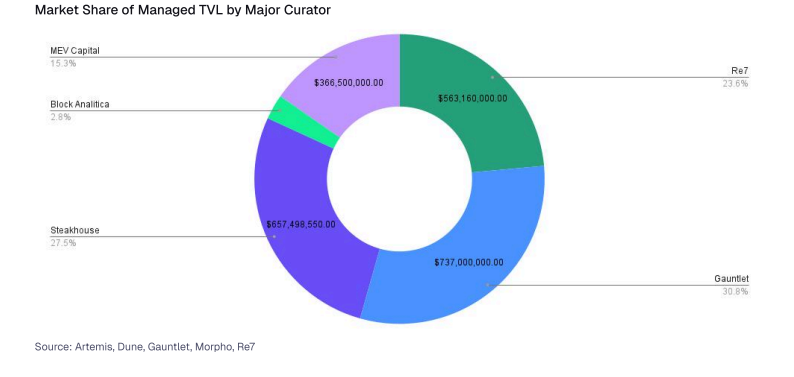

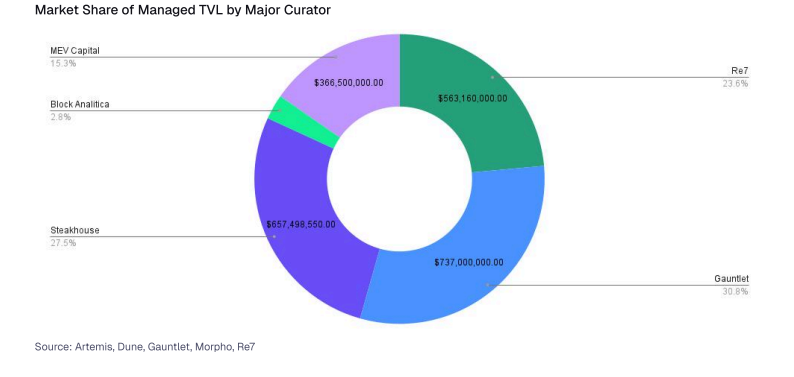

A less-visible trend is the emergence of crypto-native asset managers. Firms like Gauntlet, Steakhouse Financial and Re7 now act like fund managers on-chain: they govern protocols, fine-tune risk, and allocate capital across structured products.

According to Artemis, these specialist funds control about two-thirds of the total value that asset managers have locked in DeFi. In all, this sector’s assets under management have grown fourfold in 2025, from $1 billion to over $4 billion.

These managers have funneled money into a variety of DeFi segments – not only lending but also tokenized real-world assets and sophisticated yield markets.

Artemis points out that DeFi protocols are increasingly tokenizing U.S. Treasuries, credit funds and other assets as collateral or yield sources.

You can contact us for more informations or ads here [email protected]