Author: Bright, Foresight News

Will the Altcoin Season Come Again?

This is a question that almost all crypto players are asking. After all, during the last bull market from 2020 to 2021, very few people shouted “All in BTC,” while during DeFi Summer, there were numerous altcoins that surged fivefold. The total market capitalization of cryptocurrencies skyrocketed from about $200 billion in January 2020 to slightly over $3 trillion in November 2021. It can be said that 90% of those who truly turned the tide in this bull market were supporters of altcoins.

However, the harsh reality is that new assets will definitely come, and the explosive altcoin season, which seeks to find a sword in the boat, is already unlikely under current circumstances.

The Defeated Army of Altcoins

While many are still waiting for the altcoin season, four years later, the crypto industry has quietly approached the end of the bull market. From 2024 to mid-2025, the total market capitalization of cryptocurrencies has actually grown dramatically by 130%.

On November 15, 2021, BTC reached a peak of around $69,000, and the total market capitalization of cryptocurrencies peaked at about $3 trillion; on July 14, 2025, BTC reached a peak of $123,091, and the total market capitalization peaked at about $3.91 trillion.

In contrast, considering the garbage Memecoins that were rushed to issue during the Meme craze, there are already millions of altcoins on-chain. This time, altcoins have suffered a major defeat.

In response, perhaps all we can say is: Sorry, we failed.

The reason we cannot Make Altcoin Great Again is that the crypto industry, which is high on the theme of compliance, is experiencing the painful process of cutting away the excess fat that grew during the wild past.

Wall Street’s Land Grab Game

Under the trend of crypto compliance in the United States, Wall Street’s regular army, which originally dared not act recklessly, has begun to flood into the “雷池” (a term for a risky area) of cryptocurrencies during the Biden administration, while also planting the colonial flag of financial hegemony on-chain.

From the player’s perspective, the game structure composed of whales, retail investors, miners, and crypto institutions has vanished. Retail investors, who jokingly call themselves “Nasdaq and Dow Jones crypto traders,” have genuinely become opponents of professional hedge funds on Wall Street.

From the asset perspective, the VC-led setups and carefully designed low liquidity, high market cap strategies are no longer viable; unregulated Meme coins continue to bleed after retail investors lost interest; DeFi also seems not to have become the first choice for institutional hot money.

In fact, the wealthy institutions on Wall Street entered crypto, and the first step was to use capital power to control Bitcoin, which is factually the most “decentralized” and has the highest consensus in the crypto industry, thus gaining a voice in the cryptocurrency sector, such as Grayscale’s Bitcoin ETF; the second step was to penetrate and expand their already controlled financial power into crypto, attracting native crypto investors to switch investment categories, such as stock tokenization and altcoin “micro-strategy” companies; the third step was to issue new crypto-related assets that comply with existing financial regulations, completely mastering the pricing power of crypto assets, such as crypto company IPOs.

The hot money that native crypto investors originally hoped for from Wall Street did not foolishly flood into the already filled “decentralized” track. In other words, they chose to play their own game, and not only that, they also want to force you to play theirs with cold hard cash.

If you can’t beat them, then join them.

The Undercurrent of IPO Fever

On June 5, Circle went public on the New York Stock Exchange, with its stock price soaring over 160% on the first day, eventually reaching a peak of $289.99, a staggering increase of 9.64 times from the issue price of $31. Meanwhile, cryptocurrencies can only be said to have performed mediocrely.

Circle’s return on investment is the authentic flavor of past altcoin seasons. Following this, a series of crypto-related companies announced plans for IPOs in the second half of 2025, including domestic exchanges like Kraken, FalconX, Gemini, and Bullish, as well as fintech companies and asset management institutions like Bitgo, Grayscale, and Figure. There were even reports of OKX planning to go public in the U.S. Besides the bustling U.S. stock market, the South Korean exchange Bithumb announced a two-step strategy for listing on the Korean KOSDAQ and the U.S. Nasdaq, while the Thai exchange Bitkub stated it would list on the Thai Stock Exchange.

On July 30, U.S. exchange Kraken was reportedly seeking to raise about $500 million at a valuation of $15 billion, further stimulating the crypto industry.

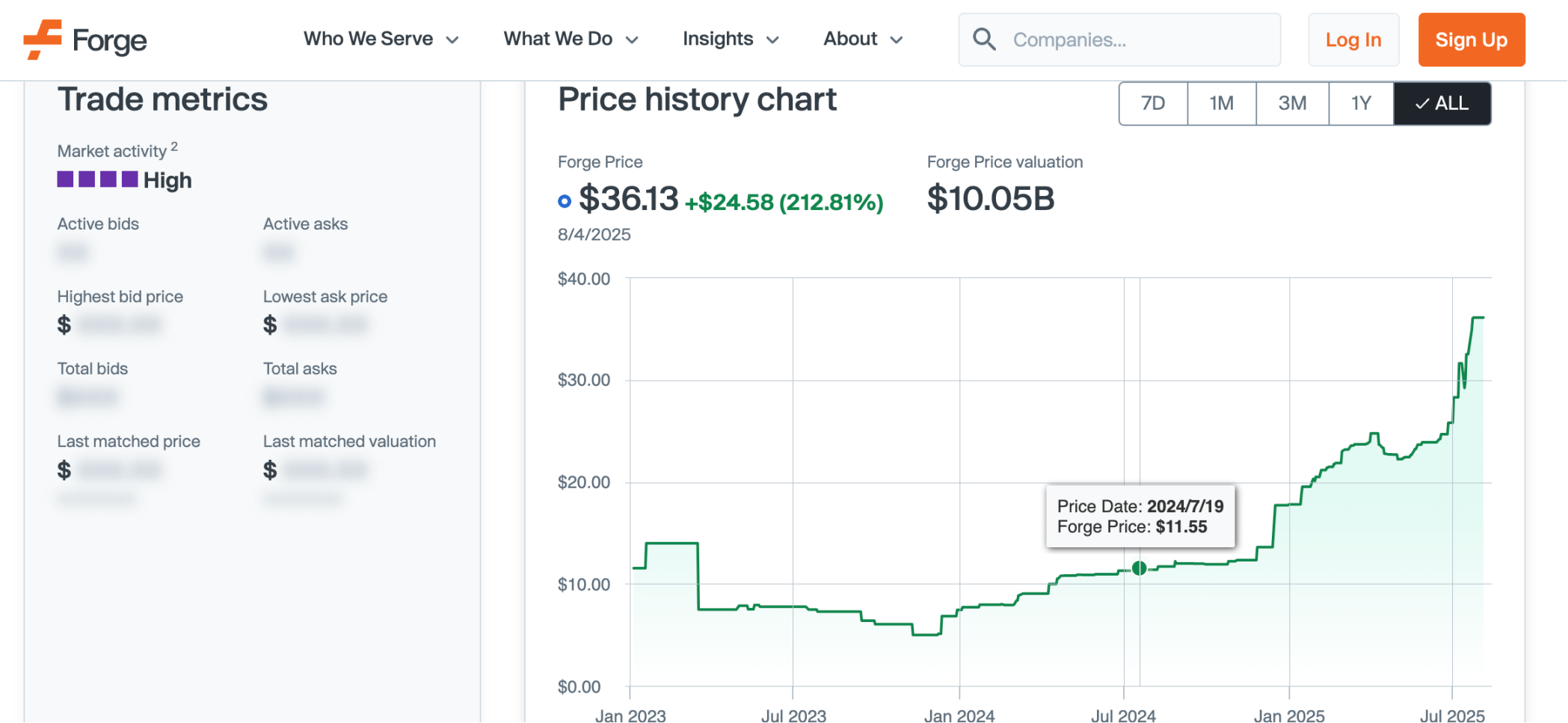

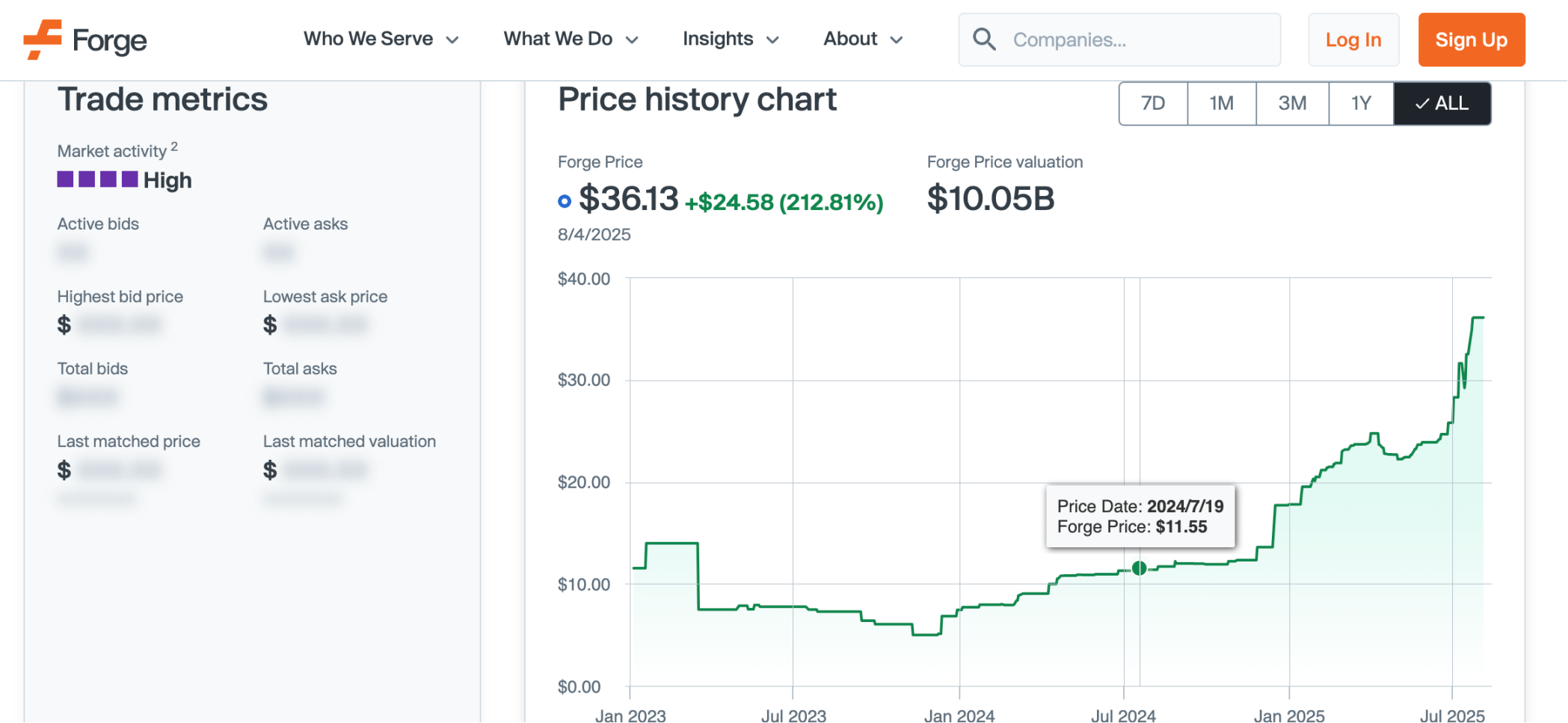

Previously, Robinhood announced its entry into stock tokenization, even launching equity for top private companies like OpenAI and SpaceX, officially opening up the imagination for Pre-IPO. As Kraken stirred up its listing expectations recently, private equity trading platforms like Forge conveniently provided access and exit channels for those “wanting to sell” and “wanting to buy early.”

Generally, investors can purchase equity in unlisted companies through two methods: the first is the P2P model, and the second is through the SPV model. Taking Kraken as an example, the P2P model involves the platform matching sellers of Kraken equity with buyers, and the trading platform assists both parties in completing KYC, due diligence, and contract signing processes. The SPV model involves the trading platform establishing a special purpose vehicle (SPV) to pool buyer funds and collectively purchase equity in the target company.

Currently, the price on the Forge platform is $36.13, with a valuation of about $10 billion. If Kraken can successfully go public at a $15 billion valuation, current entrants may achieve over 50% excess returns.

In summary, crypto company IPOs are like a rite of passage for the crypto industry. After receiving this recognition, it will gain widespread acknowledgment from the world, but this also means it must shed the outdated trinkets of its childhood. Yes, we are talking about those garbage projects that cannot calculate price-to-earnings ratios and only know how to create PowerPoint presentations.

ChainCatcher reminds readers to view blockchain rationally, enhance risk awareness, and be cautious of various virtual token issuances and speculations. All content on this site is solely market information or related party opinions, and does not constitute any form of investment advice. If you find sensitive information in the content, please click “Report”, and we will handle it promptly.

[email protected]