The first quarter of 2025 presented a mixed bag for the decentralized application (dapp) industry, according to the latest report from DappRadar. While the total value locked (TVL) in decentralized finance (DeFi) protocols experienced a significant 27% drop, the report highlighted explosive growth in the adoption of AI and social dapps.

The industry also grappled with substantial losses exceeding $2 billion due to various hacks, exploits, and scams, painting a picture of a dynamic yet volatile landscape.

DeFi Sector Faces Sharp Decline

Driven by what analysts characterize as “broader economic uncertainty and lingering aftershocks” from the catastrophic $1.4 billion Bybit exploit in February, total value locked (TVL) in DeFi protocols fell 27% quarter-on-quarter to $156 billion. Ethereum’s 45% price reduction to $1,820 during the same period aggravated the fall.

The biggest blockchain by TVL, Ethereum saw frozen value drop 37% to $96 billion. Other big networks weren’t spared either; Sui suffered the most among top-10 blockchains, with TVL falling 44% to $2 billion. TVL declines above 30% also occurred at Solana, Tron, and Arbitrum.

“Blockchains that experienced a larger volume of DeFi withdrawals and had a smaller share of stablecoins locked in their protocols faced extra pressure on top of the falling token prices,” observed DappRadar’s paper.

Berachain Bucks the Trend

Unlike market-wide challenges, recently introduced Berachain turned out to be the quarter’s best performance. Berachain is the only top-10 blockchain showing positive increase since its February 6 mainnet debut; it earned an amazing $5.17 billion in TVL by March 31.

Following a string of successful events including a Token Generation Event distributing $632 million worth of BERA tokens, the launch of developer-focused testnet Bepolia, and a significant $142 million fundraising round revealed in late March, this outstanding result followed a pattern of success.

AI and Social Applications Gain Momentum

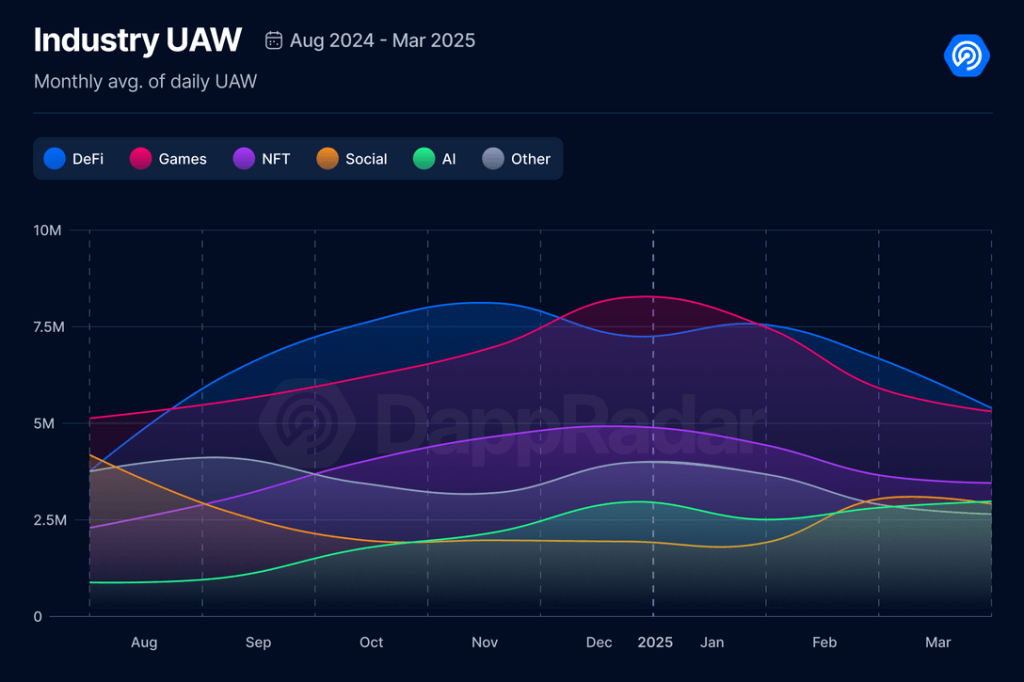

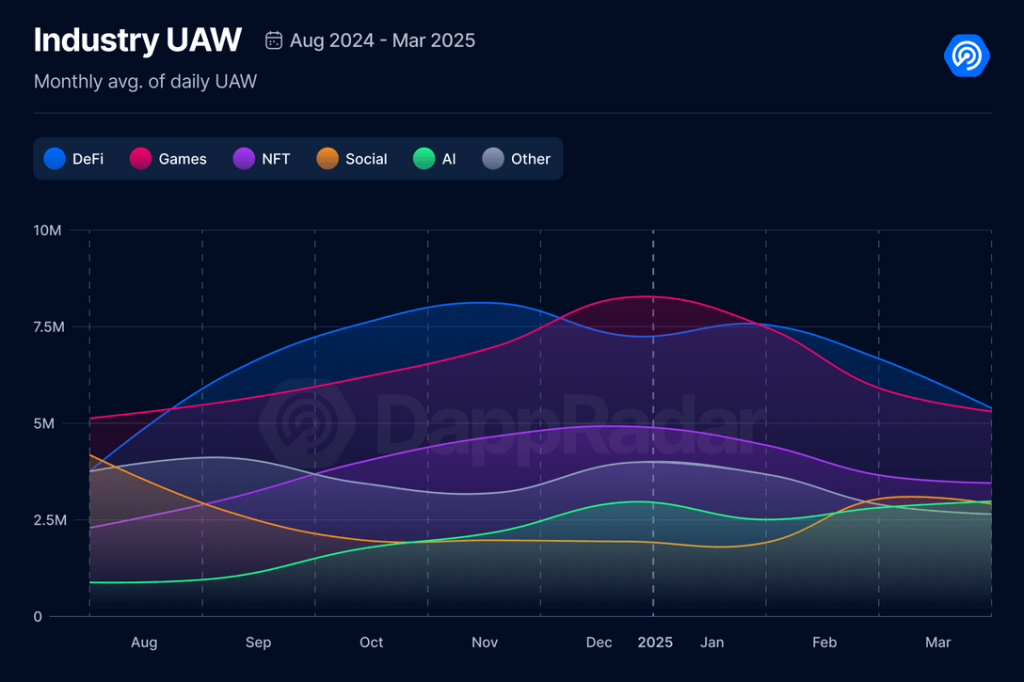

DeFi suffered, although daily unique active wallets (DUAW) interacting with AI systems climbed 29% in Q1, averaging 2.6 million users monthly. Social applications likewise climbed by 10% to 2.8 million DUAW, proving resistance against more general market headwinds.

“There was explosive development in artificial intelligence agent protocols,” DappRadar said in its paper. “They’re here, and they’re changing new user behaviors; they’re no more a concept.”

Among the leading AI apps were Dmail Network, a distributed AI-powered email system; Balance, an interactive entertainment platform supported by a16z where users construct AI agents; and LOL, a Telegram-based emotional analysis platform that rewards actual laughter with tokens.

NFT Market Contracts But Shows Emerging Trends

With OKX’s NFT marketplace winning the top spot at $606 million in sales, almost topping OpenSea’s $599 million and Blur’s $565 million, the NFT industry saw a 25% drop in trade volume to $1.5 billion.

Comprising 56% of all NFT trade volume, profile picture (PFP) collections still predominated the space. With $177 million in sales, Pudgy Penguins lead all collections; CryptoPunks, with just 477 transactions, made $63.6 million, so underscoring its ongoing premium position.

One major bright point was the rise of Real World Assets ( RWAs) in the NFT sector, which Courtyard gained popularity by tokenizing actual artifacts.

Security Concerns Amplified by Major Breaches

Over $2 billion in losses from hacks, vulnerabilities, and scams dogged the quarter—a number not seen since the Terra Luna and FTX crashes. Said to be caused by North Korea’s “TraderTraitor” gang by the FBI, the Bybit hack alone totaled $1.4 billion.

Promoted by Argentine President Javier Milei before its creators dumped 70% of the supply, the $250 million LIBRA meme coin rug pull; a similar $200 million collapse of Melania Trump’s MELANIA token; a $50 million stablecoin exploit at Hong Kong-based Infini; and a $37 million hot wallet hack at Singapore’s Phemex exchange were other notable events.

Economic Headwinds Impact Market Performance

The paper also underlined how the return of import taxes under former President Donald Trump’s new term generated extra pressure on the crypto ecosystem by upsetting the worldwide tech supply chain and setting knock-on consequences across financial markets.

Notwithstanding these difficulties, the dapp sector as a whole demonstrated resilience; 24 million daily unique active wallets only exhibited a little 3% drop from the previous quarter, implying a consistent user base despite the volatile market conditions.

Analysts remain cautiously hopeful as the sector moves into Q2 2025, hoping for ongoing innovation in artificial intelligence, identification solutions, and tokenization to propel the next blockchain wave of expansion.

You can contact us for more informations or ads here [email protected]